For a brief moment this week it seemed as though the French bank Crédit Agricole would collapse because of lack of liquidity. Such an event had been a long time coming because European banks are having increasing difficulties in rolling over their massive short-term debts. Unfortunately, Crédit Agricole is only the tip of an enormous iceberg.

Since many are convinced that the bankruptcy of a major bank will provoke a chain reaction, surpassing the financial capabilities of the ECB and the individual countries , even the survival of the euro was believed to be at stake.

Since many are convinced that the bankruptcy of a major bank will provoke a chain reaction, surpassing the financial capabilities of the ECB and the individual countries , even the survival of the euro was believed to be at stake.

That was reason enough for the President of the American Central Bank (FED), Ben Bernanke, to come to the rescue of the powerless European Central Bank (ECB):

in an unprecedented and coordinated action with several other central banks, the FED opened up its coffers and flooded Europe with cheap $-credits.

in an unprecedented and coordinated action with several other central banks, the FED opened up its coffers and flooded Europe with cheap $-credits.

This certainly solved the short-term problem of the banks and bought them a bit more time in which to implement a structural approach to the debt problem. Stock markets all over the world responded euphoricly.

The Americans themselves are not so happy with this renewed Marshall aid to Europe, as evidenced by the reaction of congresman Ron Paul who argues that this exposes Americans to unclear risks and that such actions could also boost further inflation.

As far as these risks are concerned, he may have a point. The banks in Europe use an incredidible amount of leverage to squeeze out some more profits. On average the banks have 2600 times as many assets as capital. This means that their assets only need to decline in value by 4% for the banks to be rendered insolvent.

Moreover, the current global credit bubble amounting to about $ 200 trillion (= 310% of the worldwide income), which is unsustainable without very strong economic growth, only exacerbates the already precarious position of the banks. Therefore you cannot have but sympathy with his take on the situation.

Ron Paul (and many others with him) finds that the U.S. has more than enough problems of their own:

- 45.8 million Americans (> 15% of the population) live on food stamps, the modern equivalent of soup kitchens

- 47.8 million Americans live below the poverty line

- income differences have never been greater

- family income is also back at the 1996 level, despite more dual earners

- the unmanipulated unemployment figure is probably closer to 20% than the 10%

- sovereign debt is now more than 100% of GDP, together with a budget deficit of 10%

What he fails to mention in this “the lame helping the blind” scenario is that the top five U.S. banks will also be hopelessly lost in case of Eurogeddon. They are the ones who have insured investors against the European banks defaulting by selling credit default swaps.

( According Warren Buffet the so-called weapons of mass destruction).

The US has, therefore, not offered out of the goodness of its heart, but out of desperate self-interest!

Through such actions, and constantly projecting an overly optimistic view of the economic reality, America hopes to continue the pyramid scheme. GM is a nice example of this type of manipulation:

From this graph you can see that “state-owned” GM has been channel-stuffing by raising the inventory with its dealers by more than 200,000 cars this year.The way Americans compile their statistics means that a car is considered as having been sold as soon as it reaches the dealer. This is a dangerous short-termpolicy, revealing their desperate urge to show something positive.

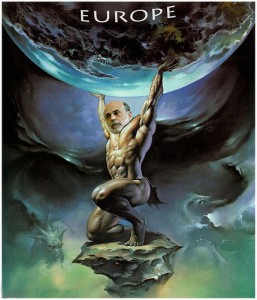

Here in Europe all hopefull eyes are now set on yet of another Mother of European summits on 9th December.

At this summit, our illustrious duo will have to cut through some Gordian knots. This time the financial markets expect nothing less than the announcement of a full European fiscal integration, with Germany handing over its wallet – and France its pride – to Brussels. If there is any doubt about the unconditional nature of the commitments or the implementation of the necesary practical measures, the deceptive calm in the markets will end abruptly.

At this summit, our illustrious duo will have to cut through some Gordian knots. This time the financial markets expect nothing less than the announcement of a full European fiscal integration, with Germany handing over its wallet – and France its pride – to Brussels. If there is any doubt about the unconditional nature of the commitments or the implementation of the necesary practical measures, the deceptive calm in the markets will end abruptly.

Furthermore, the national parliaments of the relatively richer countries will never ratify the necessary treaty amendments without explicit assurances that harsh discipline and extensive reforms are actually implemented.

In days to come, a lot of “public interest” pills will have to be distributed among the politicians. It remains te be seen if they can actually swallow them.