Recently Spain got back on the radar of investors when an auction of government bonds failed to attract enough attention, forcing the yield up to almost 7%. In light of the yield on German bonds of less than 2%, this means that the financial market is seriously doubting Spain’s ability to make good on its loans.

If you add together all debts: government debts, corporate debts, financial institution debts and household debts, Spain is even more indebted than Italy, who saw it’s interest rate rise to over 7% last week. Spain’s total debt now stands at 363% of GDP against 313% for Italy.

These kind of debt levels are certainly not an exception but once borrowers are unable to properly service their debt, then the situation gets out of control.

According to the Bank of Spain the Spanish banks have a total of € 308 billion loans to real estate companies on their books, of which at least 50% are in big trouble. Moreover these banks have 7,21 % of non-performing mortgage loans which is draining their reserves. (Reuters) To make matters even worse banks hold about € 31 billion of unsellable real estate.

So far the domestic Spanish banks have written off 30% of all these assets. Were they to be valued truly, market to market, the banks would at least have to double their write-offs, rendering them instantly insolvent and in need of extra capital.

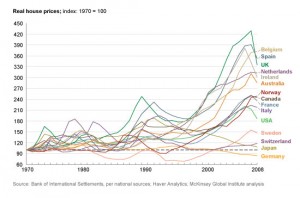

How did they come into this mess? The graph, shown below, sheds some light on this debacle:

As you can see the real estate mania was not confined to Spain alone. The difference for countries like Spain and Ireland is that too big a part of the economy depended on the construction business.

Once the crisis of 2008 and the extremely run-up prices drove buyers away, Spain got stuck with an overhang of 1,500,000 houses. At the current speed of sales it will take until at least 2015 to get rid of them, according to consultant RR de Acuna.

What is not helping in this process of destocking, is the reluctance of banks to lower prices to market value. They desperately want to avoid damaging their balance sheets any further and are supported in their effort by cheep loans from the government and the ECB.

This unwise attempt to prohibit market forces to do their work (“creative destruction“), is only making matters worse. Scarce capital is being used to keep insolvent banks alive in hopeless expectation that future growth will save the day.

In the meantime a big part of this overhang deteriorates rapidly as a result of the lack of maintenance. The longer they wait the more lopsided the banks become. Debts keep accumulating while their assets depreciate in value.

In other places in the world, like Miami, where markets were allowed more freely to establish a new equilibrium between demand and offer, excess supply of houses was cleaned out rapidly.

If the price is right there is plenty of money around looking for investments. Spain still has a lot to offer as ideal tourist and retirement destination with its wonderful climate and state of the art infrastructure.

Blocking attractive lower prices just to prevent the bankruptcies of already doomed banks will prove to be very counterproductive.

Quickly getting rid of a big part of the overhang will do wonders for the local economy and could even restore the balance of payments of the overall Spanish economy, making the country less depended on foreign financing.

interesting article, I don’t agree with the figures quoted. Spain debt to GDP 61% vs Italy 118% is more accurate.

Needles to say the correction does not change the point of the article, nor the question it poses, “Is there a solution to Spain’s debt crisis?” The answer is yes, but the Spanish banks don’t want to listen to it – with their heads berried in the sand. Nor did the last government, lets see what the incoming government can do.

Spain’s debt problems stemmed from 2008 financial crisis, there is no short cut in deleveraging process, but if the right policy options are chosen, it can be less painful and shorten the recovery period.

To curb the present crisis, Spain needs a two pronged strategy. One is economic reforms which include banking reforms on non-performing assets derived from previous crisis. The real estate sector follows the business cycle, ebb and flow. The glut is difficult to clear under such an adverse environment. Especially, the deleterious effects of austerity package in the Euro arena ostensibly to rescue the economies, but making condition worse, it is hard if not impossible to attract investors; so the second prong of strategy is to lift the economic growth.

Greece mires into recession for four years and still can’t see light in the tunnel, the fluff is no economic growth, paucity of new sources of income to alleviate debt burden. Compared with Greece, Spain is in better shape in terms of competitiveness. Probably structural reform to curtail bureaucracy and labor market rigidness will help to attract foreign investors.

Under high debt environment, foreign investment is a faster way to deleverage without using your own scarce resources, it helps to decrease unemployment measurably and improve tax collections. That is enough to get spain back on track. Unfortunately, the regulations and rigid labor market may be the Achilles heel, making foreign investment not conducive.

It may not be the best solution, but certainly a cogent solution to alleviate Spain problems.

I think there is a more simple solution. The only way out (for any country) of the levels of debt currently held is to either grow or inflate your way out – or a combination of both. To do that, you need control of your own currency. Therefore Spain needs to leave the Euro. It is the ONLY solution to theirs, Greece, Portugal et al debt problem

Austerity must be another word for failed Socialism. Which is really what you are referring too via rigid labor market. It always seems those in charge think the solution is the same poison that caused the crisis. If anyone would take the time to scan a few charts fromt he Great Depression they would see the depression of the 1930s only go worse when they started passing out more money. By the way, only in the United States did they call it the Great Depression. I realize you are going after the solution but I wanted to identify the problem first.

So if spending is the problem then cutting spending is the solution. It is just that simple. Relying on other countries to bail you is making them your master and you their peasant.

Nowhere did I mentioned in my comment about bailing out, I mentioned foreign direct investments. As to bailing out, it is about what choices you have, much less about your wish, Greece is a case in point. Your comment also confuses me between austerity and spending cut.

Yes, more income than expenses.

With the recent change in government and the PP finally in power after 7 years of a sinking economy, there is hope in Spain that things will get better soon. I still have family there, and they are all seeing a more positive outlook in their jobs. We just hope it happens sooner rather than later… too many young Spanish people have left,

Tan, Ron and all:

The article stated, “According to the Bank of Spain the Spanish banks have a total of € 308 billion loans to real estate companies on their books, of which at least 50% are in big trouble. Moreover these banks have 7,21 % of non-performing mortgage loans which is draining their reserves. (Reuters) To make matters even worse banks hold about € 31 billion of unsellable real estate, or 1.5 million houses for sell.”

As more houses stay on the market, the prices will continue to drop. Well, it seems that this is a great time to buy for any investors. Government, banks and construction firms should work together to solve this problem. When the prices go to the floor, investors will buy. Question is: Where is the floor?

Yes there is a solution –they should stop defrauding all the world.Maybe then someone will actually consider investing in them

Hsu, seems the western world all followed the same policies as the USA. Wonder if Spain is attempting to prop up the housing prices as is America.

It is a very good discussion. We got to know that, Global Economics is unpredicatable. No one knows, what would be happened tomorrow. I agree with Donald Hsu & others. Europian Economics is behind for few decad. At this moment, needs strong Leadership and Master planner who can guide this situation…and over come it. Banking policy need to be chainged too… Lots of gap at Europian Banking system…Need to be rectify.

I’ll add that FannieMae and Freddiemac were key players. If that had been a private enterprise this wouldn’t have happened. Maybe I should say less likely to happen.Then of course you had the borrowers and the banks. The banks I’m told were persuaded by costly threats of audits. I’m not sure. Still though those same banks were cozy with politicians. Then you have the debts being rolled up and sold as investments. It was insanity. Seems to have been on a global scale.

I’m not sure about your solution. It’s possible you may be right though. One thing for sure is to let the market work and then those homes will sell and eventually the market prices will come back.

My brother and I have talked about buy a home in Florida since the prices are so low. Right now my hunch is there is a huge pent up demand but everyone is waiting for a change in governments and stability in employment.

Sumita and all: Thank you for reading.

Ron, investing in real estate for Florida takes time. Two ways you can make money:

1. rental income

2. appreciation

For Florida, #2 is difficult because the prices are dropping.

#1 is possible. I will find a local university or military base. Once you identify the town, buy a house or multiple apts, then rent them for 5 years. College students or soldiers pay you mortgage. Then price of the house appreciates after 5 years, sell it for profit.

Pingback: Homepage

Pingback: URL

Pingback: Gregory Smith